Why I Took a Private Equity Course

/My Adventures in Executive Education

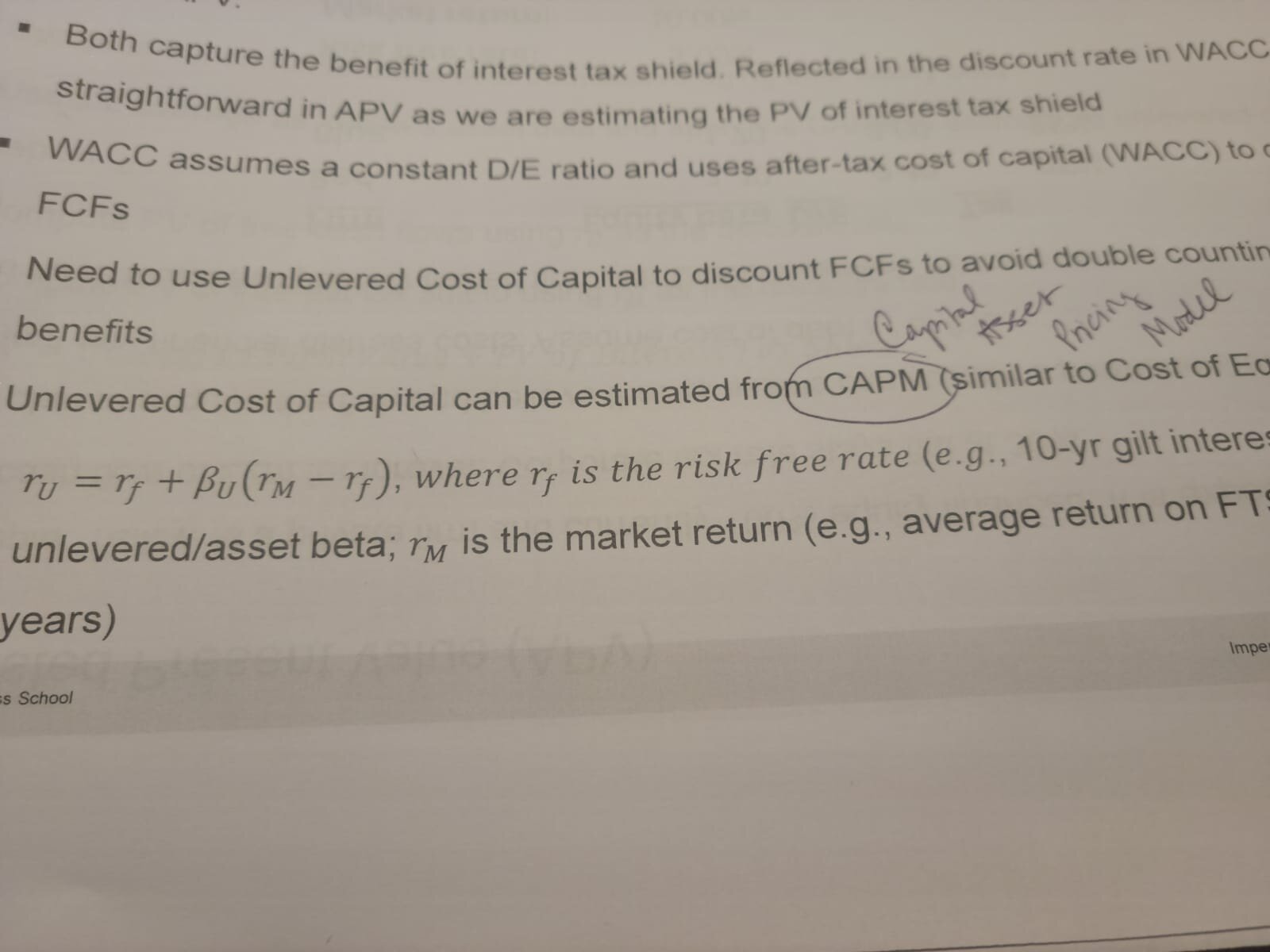

“It’s very simple. Estimate the unlevered cost of capital from CAPM. The WACC assumes a constant D/E ratio and uses after-tax cost of capital. Then, find the DCF…”

I briefly turned off my camera on Zoom to hang my head and scream softly in frustration.

Why was I doing this to myself?

If you’ve been reading this blog for a long time, you’ll have read me advocating for continuing your education and growing your skill base.

Learning new topics, like data privacy, trade control, or ESG, can provide you with new opportunities you wouldn’t have qualified for previously. Classes can expand your network and your thoughts about what is possible. But, expanding your education can be painful, as I learned recently.

My foray into finance

In May, I signed up for the Private Equity course at Imperial College London’s executive education program. Spark Compliance’s facilitated training game software, Compliance Competitor, was growing so fast that I was (and still am) considering venture capital to grow it.

Spark Compliance had been hired by a private equity firm to review compliance at its portfolio companies, and several of our new clients were private equity-owned.

I had two objectives:

I wanted to understand the words used by the private equity folks. In my experience, correctly using industry words makes people feel you understand them and are one of them.

I wanted to learn how people in the private equity firms think about deals.

Imperial College advertised the class as being for people already in private equity looking to expand their careers, people in finance interested in transitioning to private equity firms, and CEOs and executives at companies that might take venture/private equity money.

Bingo!

Number three applies. I applied for admittance and was thrilled to be accepted.

As I filled in the credit card form, I noticed that the sign-up page had a note that said, “this class will not focus heavily on valuations. You do not need a finance degree to take this class.” Well, that was good since I had a law degree and a film and television degree.

Going back to math class

True confession: the only time I got a near-failing grade (D) in my entire academic career was in math the spring semester of my junior year of high school. I didn’t understand the concepts at all.

My undergraduate degree required two math/science classes. I took microbiology and astronomy. I thought math was behind me for good.

Turns out that running a company requires a fair amount of math. Usually the math is pretty simple…

Revenue minus expenses equals profit.

I thought I’d be relatively prepared for the private equity class. I was wrong.

I wanted to give up

The first week of the private equity class was pretty good. We did a case study and I was able to contribute from a non-finance perspective. People in the class didn’t consider sanctions issues or bribery concerns in the deal, so I felt good about having something to add.

By week three, the math descended. I spent hours on Investopedia trying to understand the words being used because not understanding them meant I couldn’t start working on the equations.

By week six, I was burned out and frustrated. I flirted with the idea of giving up. This class was taking eight or more hours of my time per week. That meant giving up significant chunks of time on weekends or working late into the night. It was exhausting.

When it was darkest, I posted to my class’s WhatsApp group about my frustrations and feeling defeated.

A classmate sent back this message, “I’m actually learning so much from you Kristy. This includes how you are responding to whiteboard questions. You are helping me (from a non-finance background) to understand many of the concepts. Don’t feel demotivated. You are truly inspiring me to stay the course.”

Wait, I was making a difference? Really?

I realized that my objectives were being met. I was learning the words, even if I had to look them up six times. I was learning how private equity firms think about deals. I decided that even if I failed the course, which I was pretty sure I would, I had come here to learn and I was. I chose to see it through.

I finished the class in August and was elated when I learned I’d passed. My certificate made me genuinely proud.

Just go for it!

The first step to growth is simply to sign up. Choose a class, seminar, webinar, or other opportunity. Accept that it will be uncomfortable – even expect it. Growing your mind and career is worth the pain and potential embarrassment.

Am I ever going into private equity as a career? Heck no!

But foraying into an area where I was deeply uncomfortable helped me to grow. Meeting new people in a totally different field expanded my network – especially when you consider all of the contacts-of-contacts I now have access to.

Update - I did learn how to calculate the WACC and DCF. I have a certificate to prove it, and that is worth its weight in gold.